PMEGP Loans to help you start your dream business! Apply online in just a few clicks.

Want to start your own dream business? Want to leave the traditional job life and become an entrepreneur? Then there is good news for you, the Prime Minister’s Employment Creation Program will help you fulfill your dream.

With the PMEGP scheme, you can get a loan to start your own small business very easily. The good thing is that you don’t have to wait in line at the bank for hours. Apply online for a PMEGP loan with just a few clicks.

Table of Contents

What is PMEGP Loan?

The Prime Minister’s Employment Generation Program (PMEGP) is a scheme run by the Central Government through which financial assistance is provided to entrepreneurs to start small businesses.

The interest on these loans is very low and the government gives 25 to 35 percent subsidy on the loan up to a maximum of twenty lakh rupees, that is, if you take a loan of 20 lakh rupees, you have to pay back only 15 lakh rupees.

Who Can Get PMEGP Loan?

Any Indian citizen between 18 to 65 years old can apply online for this loan. But there are several conditions, the entrepreneur can take this loan if he starts a new business. Also, he cannot take this loan if he has taken any loan from the central government before this.

How to apply for PMEGP Loan

The process of applying PMEGP loan is very easy just follow the below steps:

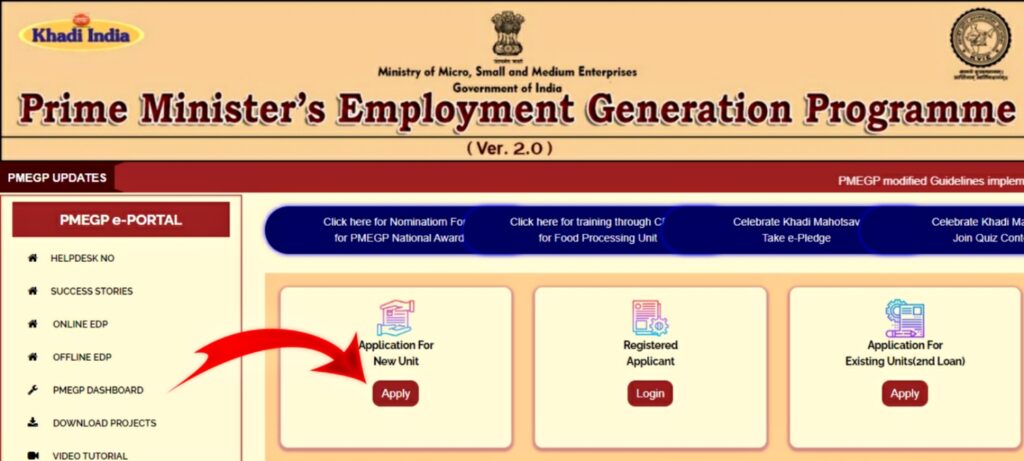

- Visit the official website of KVIC: https://www.kviconline.gov.in/

- Click on the “PMEGP Online Application” link.

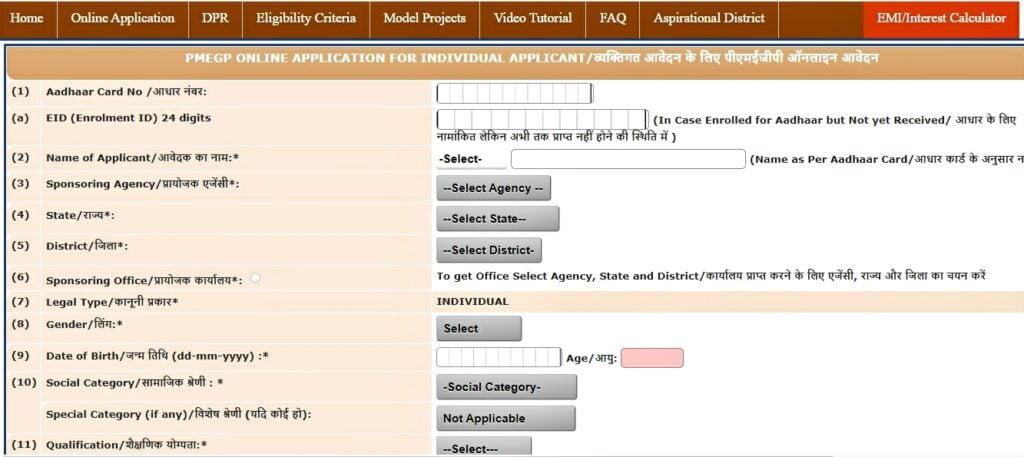

- Select “Application For New Unit” and fill in your details.

- Select your business type and required loan amount.

- Upload project report and other required documents.

- Submit the online form and note the received application number.

Required Documents for PMEGP Loan

- Passport Size Photo

- Highest Educational Qualification

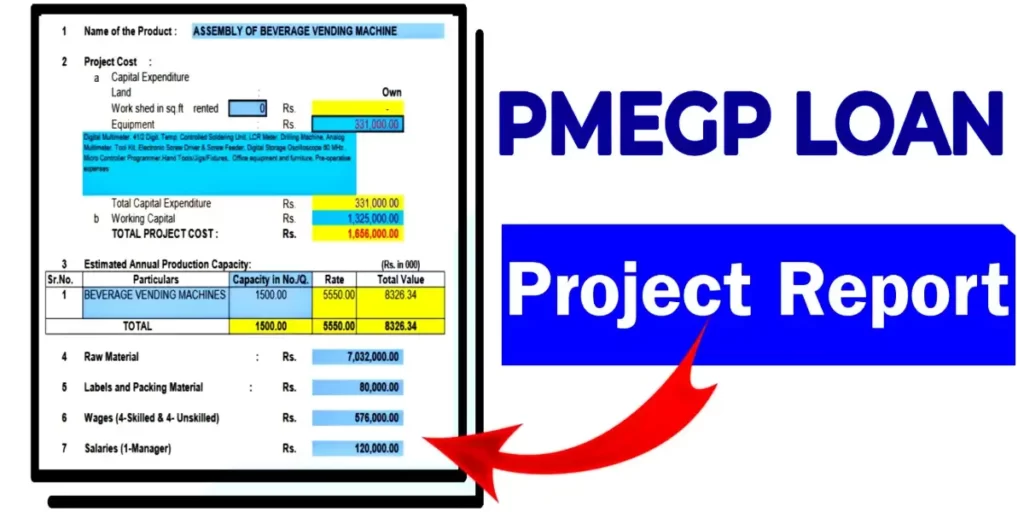

- Project Report Summary/ Detailed Project Report

- Social/ Special Category Certificate, if applicable

- Rural area certificate if applicable

PMEGP Loan Eligibility

- Any individual, above 18 years of age

- There will be no income ceiling for assistance in setting up projects under PMEGP.

- For setting up of project costing above Rs.10 lakh in the Manufacturing sector and above Rs. 5 lakhs in the Service/ Business sector, the beneficiaries should possess at least VIII standard pass educational qualification.

- Rural and urban areas both are applicable.

- Applicant should have a valid Aadhaar Number.

Additional Tips

- Read the complete instructions of PMEGP carefully before applying.

- Prepare the project report carefully, it is very important.

- Upload all the documents correctly.

I am V. Manohar, a B.Sc graduate. I am working on an online application and form fill-up-related work. Apart from keeping an eye on various government schemes, I like to share information about them through the Moneygita.