Vishwakarma Loan Application Form 2023, PM Vishwakarma Loan Apply Online

On this Independence Day, our honorable Prime Minister Shri Narendra Modi has announced a great scheme named “PM Vishwakarma Scheme” to improve the livelihood of artisans and craftspeople for their safe future.

Table of Contents

Vishwakarma Loan 2025 Overview

| Topic Name | Vishwakarma Loan |

| Launched By | Honorable Prime Minister Shri Narendra Modi |

| Under Category | Atma Nirbhar Bharat |

| Scheme Starting Date | 17th September 2023 |

| Scheme Launch Date | 15th August 2023 |

| Beneficiaries | Artisans and Craftspeople, Small Businesses |

| Budget | Around Rs 13,000 to Rs 15,000 Crore. |

| Loan Amount | Rs 3,00,000 (Rs 1,00,000 in 1st Trance & Rs 2,00,000 in 2nd Trance) |

| Loan Interest | 5 % |

| Objective | Skill training, Modern tools usage, Incentives for digital transactions, and Market linkage support. |

| Official Website | https://pmvishwakarma.gov.in/ |

What is the Vishwakarma Loan?

The Vishwakarma Scheme is a great path created for all artisans and craftspeople (also known as “Vishwakarmas”) launched by the Government of India to give them all the facilities and benefits thus improving their lifestyle and business growth overall.

The Vishwakarma Scheme’s primary goal is to provide support to artisans and craftspeople so that the Indian culture and old traditional skills can prevail with better plans for the future. The Union Cabinet has finally approved a budget of Rs Rs 13,000 Crore which is basically for the Financial Year 2024-2028.

Upgradation of skills, better marketing of their products, and improvement of their business more effectively are the main highlights of the Vishwakarma Scheme.

PM Vishwakarma Status Check

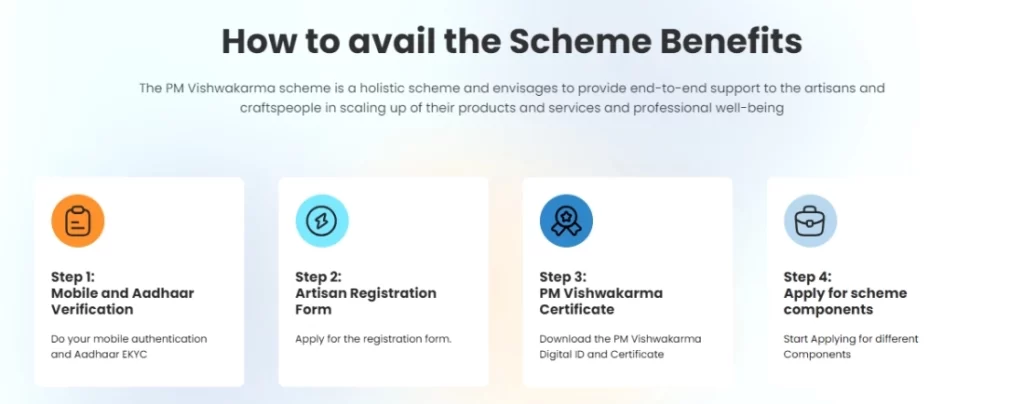

- Visit the official website of the scheme→https://pmvishwakarma.gov.in/

- Click on the Login option on the homepage→then click CSCLogin and finally click on the “CSC- View E-Shram Data” option.

- Enter the CSC UserId and Password for successful sign-in.

- Now click on the Artisan Registration process option.

- Complete the online registration form by filling in personal details, trade-related information, and bank account details.

- On successful submission, we will receive the Vishwakarma Digital ID and Certificate.

- Now for the Vishwakarma Loan Apply Online option, we have to log in again to the PM Vishwakarma Yojana Portal (https://pmvishwakarma.gov.in/) and click on the “Apply for Loan” option.

- Select the loan type and enter the required details.

- Then check your application form details and click on the “Submit” button.

Vishwakarma Loan Application Form

For Vishwakarma loan application common people have to go to the CSC center and their CSC holders will make their Vishwakarma loan application.

Who Are Eligible?

- The applicant must be an Artisan or Craftsperson/Craftsman engaged in a family-based traditional business.

- Must be a member of the Vishwakarma Community of the selected trades list.

- The applicant must be engaged in the unorganized sector totally on a self-employment basis.

- Applicant’s age should be between 18 to 60 years.

- The applicant must hold a valid PM Vishwakarma Digital ID and Certificate.

- The applicant or any of their family members must not be engaged in any Government service job.

- Requires a bank account number.

What Are The Documents Required?

- PM Vishwakarma Digital ID and Certificate

- Aadhaar card

- PAN card

- Bank account statement

- Income proof

- Proof of residence

- Proof of business

- Valid Mobile Number.

PM Vishwakarma Loan Amount Details

| Trances | Amount Of Loan | Repayment Tenure |

| 1st Trance | Upto Rs 1,00,000/- | 18 Months |

| 2nd Trance | Upto Rs 2,00,000/- | 30 Months |

With the detailed chart given above, the PM Vishwakarma Scheme Loan amount details have been described precisely, and for additional information let’s scroll down further.

- Under the Vishwakarma Scheme, the total loan assistance would be Rs.3,00,000/- in which the beneficiaries can avail of the first loan tranche up to Rs. 1,00,000/- and second loan tranche up to Rs 2,00,000/- respectively.

- The second loan tranche is available to skilled beneficiaries who have already maintained a standard loan account and have done digital transactions in their business period.

- The first loan tranche must be fully cleared before availing the second tranche.

- Now as per the Vishwakarma Scheme the concessional rate of interest of 5% will be charged to the beneficiary applying loan.

- A subvention cap of 8% is to be paid by MoMSME for the benefit of the applicant applying for the loan.

What Is The Training Stipend And Toolkit Incentive?

- All eligible beneficiaries will receive a training stipend of Rs. 500 per day during the Basic and Advanced Training programs.

- So if someone completes a 15-day skill training, an amount of Rs 15,000/- will be given as a training stipend at the end of it.

- The training stipend will be credited to the individual beneficiary’s account through the DBT mode at the end of the training and certification by MSDE.

- Under this PM Vishwakarma Scheme, a toolkit incentive of Rs. 15,000 is also to be provided to all the artisans and craftsmen after their skill verification which will be at the start of Basic Training.

Who Are The Eligible Trades Applicable For The Vishwakarma Loan?

Wood Based

- Carpenter (Suthar)

- Boat Maker

Iron/Metal Based/ Stone Based

- Armourer

- Blacksmith (Lohar)

- Hammer and Tool Kit Maker

- Locksmith

- Sculptor (Moortikar, stone carver), Stone Breaker

- Manufacture of Bronze, Brass, Copper, Dias, Utensils, Figurines, etc.

Gold/Silver Based

- Goldsmith (Sunar)

Clay Based

- Potter (Kumhaar)

Leather Based

- Cobbler (Charmakar)

- Shoesmith/ Footwear Artisan

Architecture/ Construction

- Mason (Raajmistri)

Others Trades

- Basket/ Mat/ Broom Maker/ Coir Weaver

- Doll & Toy Maker (Traditional)

- Barber (Naai)

- Garland Maker (Malakaar)

- Washerman (Dhobi)

- Tailor (Darzi)

- Fishing Net Maker

What Are The Objectives

- The primary objective of Vishwakarma Scheme is to provide financial assistance to artisans for business development.

- Recognition of artisans and craftspeople as Vishwakarmas thus making them eligible to avail of all the benefits under the Scheme.

- Providing skill upgradation training programs to implement their skills and create better business opportunities available to them.

- To provide support for the usage of better and modern tools to enhance their capability, productivity, and quality of final products.

- Providing incentives for digital transactions, which will automatically encourage the digital empowerment of these artisans and craftspeople (known as Vishwakarma)

- To provide a platform for brand promotion and market linkages to help them access new opportunities for growth.

- Creating a platform for brand promotion and new market linkages targetting new opportunities for growth.

What Are The Benefits

- Easy Accessible For Loans: The PM Vishwakarma Loan Application Form makes it easy for artisans to apply for loans from banks and financial institutions.

- Simplicity: The PM Vishwakarma Loan Application Form is very simple and can be submitted online or at any bank branch.

- Low-Interest rates: Under the PM Vishwakarma Loan offers, artisans and craftsmen will be able to get subsidized loans at a concessional interest rate of 5%.

- Flexible Repayment Options: The PM Vishwakarma Loan offers artisans and craftspersons flexible repayment options, so they can repay the loan in a very convenient way.

- Business And Financial Growth: With the loan applied amount, the artisans can shape up their business structure towards a profitable path.

I am V. Manohar, a B.Sc graduate. I am working on an online application and form fill-up-related work. Apart from keeping an eye on various government schemes, I like to share information about them through the Moneygita.